IRS Tax Refund Deposit Schedule 2026: As the 2026 tax season approaches, millions of people across the United States are preparing to file their federal income tax returns. For many households, a tax refund is not just extra money but an important financial resource. It is often used to pay monthly bills, reduce debt, or manage early-year expenses such as rent, utilities, and insurance. Because of this, understanding when an IRS refund might arrive is a top concern for taxpayers.

Although the IRS does not publish exact refund dates for each person, past refund patterns provide a strong idea of how the process usually works. Knowing these timelines can help reduce stress and allow families to plan their finances more confidently.

How the IRS Tax Refund Process Begins

Once a tax return is submitted, the IRS starts reviewing the information provided. This includes checking reported income, verifying tax credits, and matching details with employer and third-party records such as W-2 and 1099 forms. The IRS must confirm that all information is accurate before approving a refund.

The length of this review process depends on several factors. Returns that are complete and accurate usually move faster. If any discrepancies appear, the IRS may need additional time to review the return before releasing a refund.

Why Filing Method Matters for Refund Timing

The way a taxpayer files their return has a major impact on how quickly a refund is processed. Electronic filing is much faster than filing a paper return. E-filed returns enter the IRS system immediately and reduce the need for manual handling.

Paper returns, on the other hand, require physical processing and often face delays due to backlogs. Because of this, refunds from mailed returns can take several weeks or even months longer than refunds from electronic filings.

Choosing Direct Deposit Speeds Up Refunds

The method used to receive a refund is just as important as how the return is filed. Direct deposit is the fastest and safest way to receive an IRS refund. When funds are sent electronically to a bank account, delivery usually takes only a few business days after approval.

Taxpayers who choose to receive a paper check by mail often wait much longer. Mailing time and postal delays can add weeks to the process. Direct deposit also reduces the risk of lost or stolen checks.

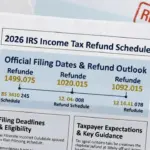

IRS Tax Refund Timeline for 2026

The IRS is expected to begin accepting 2025 tax returns on January 26, 2026. Based on past years, most electronically filed returns with direct deposit are processed within about 21 days. In some cases, especially for simple and error-free returns, refunds may arrive in as little as two weeks.

However, these timeframes are only estimates. Refund timing can vary depending on IRS workload, verification needs, and individual tax situations. Not all taxpayers will receive refunds at the same pace.

Why Some Refunds Take Longer

Certain tax returns require additional processing time. Returns that claim the Earned Income Tax Credit or the Additional Child Tax Credit are legally held until at least mid-February. This delay allows the IRS to perform extra verification to prevent fraud.

Other issues can also slow refunds. Missing documents, incorrect Social Security numbers, or mismatched income records may trigger further review. If the IRS requests identity verification, responding quickly can help avoid extended delays.

How to Track Your IRS Refund

Taxpayers do not have to guess where their refund stands. The IRS provides official tools such as the “Where’s My Refund?” tracker and online IRS accounts. These tools usually update within 24 hours of electronic filing and show whether a return has been received, approved, or sent.

Checking these tools regularly provides the most accurate information. Third-party websites or social media claims should not be relied on for refund updates.

What Most Taxpayers Can Expect in 2026

For most taxpayers, refunds will arrive sometime between late January and April 2026. Those who file early, use electronic filing, and choose direct deposit are more likely to receive refunds sooner. Returns filed later in the season or those requiring extra review may take longer.

Understanding these general timelines helps set realistic expectations. While the IRS cannot guarantee exact dates, following best practices can improve the chances of faster processing.

How to Improve Your Chances of a Faster Refund

Preparing documents early and double-checking information before filing can prevent common errors. Ensuring that bank details are correct and choosing direct deposit can also make a significant difference. Filing electronically as soon as all required forms are available helps move the return into processing early.

These steps do not eliminate all delays, but they reduce the most common causes of slow refunds.

The 2026 tax season will follow familiar IRS refund patterns. While no exact schedule applies to everyone, understanding how the system works can reduce uncertainty. Filing early, choosing electronic options, and staying informed through official IRS tools remain the best strategies.

A tax refund can provide important financial relief, and knowing when it may arrive helps households plan more effectively. Preparation and patience are key to navigating the refund process smoothly.

Disclaimer

This article is for informational purposes only and does not provide financial, legal, or tax advice. IRS refund timelines are estimates and may change based on processing conditions and individual tax situations. Taxpayers should rely on official IRS resources or consult a qualified tax professional for accurate and personalized guidance.