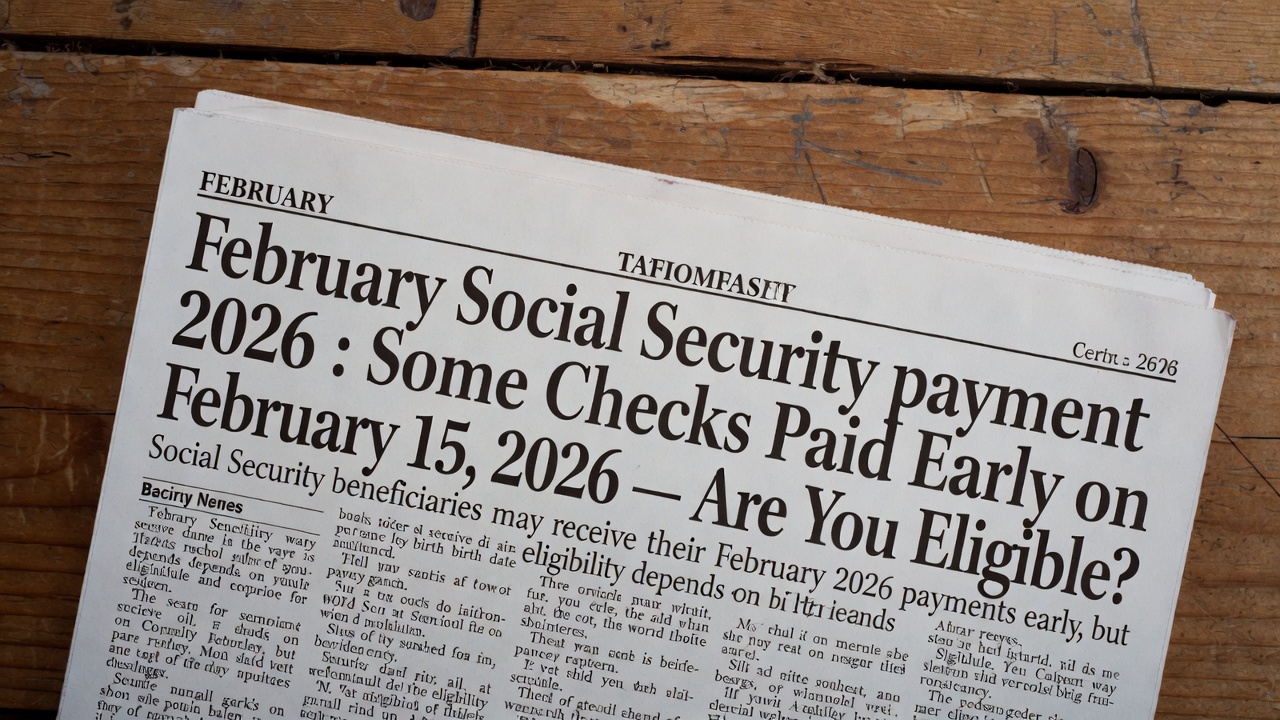

The February Social Security payment 2026 schedule is getting attention earlier than usual, and the reason is simple but important. For many Americans who depend on Social Security and Supplemental Security Income, the timing of monthly payments is just as critical as the amount received. In February 2026, certain beneficiaries will see their money arrive earlier than expected, not because of a new policy or bonus, but because of how the calendar falls this year. These routine adjustments often cause confusion, especially for seniors and disabled individuals who manage very tight budgets.

February already stands out because it has fewer days than other months. When weekends and federal holidays overlap with regular payment dates, the Social Security Administration adjusts the schedule to ensure payments are not delayed. Understanding who will be affected and why can help beneficiaries plan better and avoid unnecessary worry.

How the February 2026 Calendar Affects Payments

The main reason behind the February Social Security payment 2026 change is the placement of weekends and a federal holiday. In 2026, February 15 falls on a Sunday, and it is followed by Presidents’ Day on Monday, February 16. Since Social Security payments are not issued on weekends or federal holidays, any payment scheduled for those days must be sent earlier.

Also Read:

$1,000 or $3,000 Refund? The Route Your Return Takes Changes Arrival Time | IRS refund routes

$1,000 or $3,000 Refund? The Route Your Return Takes Changes Arrival Time | IRS refund routes

As a result, affected payments will be issued on the last business day before the holiday break, which is Friday, February 13. This is not a last-minute decision or special action by the SSA. The payment system is designed years in advance to account for these situations. Similar early payments happen almost every year around certain holidays, but they often surprise recipients because they are noticed individually rather than announced broadly.

Who Will Receive an Early Payment in February 2026

Not all Social Security recipients will see an early deposit in February 2026. The early payment mainly affects people whose benefits are tied to fixed calendar dates rather than birthdays. This includes Supplemental Security Income recipients and individuals who receive both SSI and Social Security benefits, often called dual beneficiaries.

For these groups, the regular mid-month payment date will shift forward. Instead of waiting until after the weekend and holiday, their full monthly benefit will be deposited on February 13. This means there will be no payment on February 15 or February 16 for them, as the money has already been issued.

Who Will Not Be Affected by the Change

Many Social Security beneficiaries will see no change at all in their February payment schedule. Retirees, disabled workers, and survivors who are paid based on their birth dates will continue to receive payments on their usual Wednesdays. This system divides payments across the month to manage processing smoothly.

People born between the 1st and 10th of the month will receive payments on February 11. Those born between the 11th and 20th will be paid on February 18, while those born between the 21st and 31st will receive their money on February 25. For these beneficiaries, February 2026 will feel like a normal month.

No Extra Money, Just Earlier Timing

One common misunderstanding around early Social Security payments is the belief that an early deposit means extra money. In February 2026, this is not true. The early payment is simply the regular monthly benefit sent ahead of time because of the calendar. The total amount received over the year does not increase.

This misunderstanding can sometimes cause financial strain. When money arrives earlier than expected, it may feel like a bonus, leading some people to spend it too quickly. The gap until the next payment remains the same, and in some cases, it can feel longer. For households with limited savings, this can make the end of the month more stressful.

Budgeting Challenges for SSI and Low-Income Beneficiaries

The February Social Security payment 2026 adjustment may seem small, but it can have a big impact on people living month to month. SSI recipients, in particular, often plan their spending very carefully. Receiving money two days early does not make February longer; it simply moves the pressure point forward.

Advocacy groups often recommend treating early payments as if they arrived on the original date. This mental approach can help prevent running short before the next deposit. Fixed expenses like rent, utilities, and medical costs do not change just because the payment came earlier.

How to Confirm Your Exact Payment Date

With so much information circulating online, it is important to rely on official sources. The SSA’s online account system allows beneficiaries to check their payment dates and benefit details directly. Those affected by the February shift should look for their payment on February 13 and allow time for banks or Direct Express cards to process the deposit.

If a payment does not appear immediately, experts suggest waiting at least one business day. Posting times vary by financial institution, and holiday-related delays can slow updates. Most issues resolve on their own once the banking system completes processing.

What This Means for the Rest of the Year

Calendar-related payment changes like this are not unusual and will continue to happen whenever fixed benefit dates fall on weekends or holidays. February is especially prone to these shifts because of its shorter length and mid-month federal holidays. Learning these patterns can help beneficiaries anticipate changes rather than be surprised by them.

There are no expected changes to the overall Social Security payment system in the near future. However, better awareness can reduce confusion and stress. Knowing that the February Social Security payment 2026 adjustment is routine can help households plan confidently and avoid unnecessary panic.

Disclaimer

This article is for informational purposes only and is based on standard Social Security Administration payment scheduling rules. Payment dates may vary depending on individual circumstances and financial institutions. Readers should verify their specific payment details through official SSA channels or consult a qualified financial advisor for personal guidance.