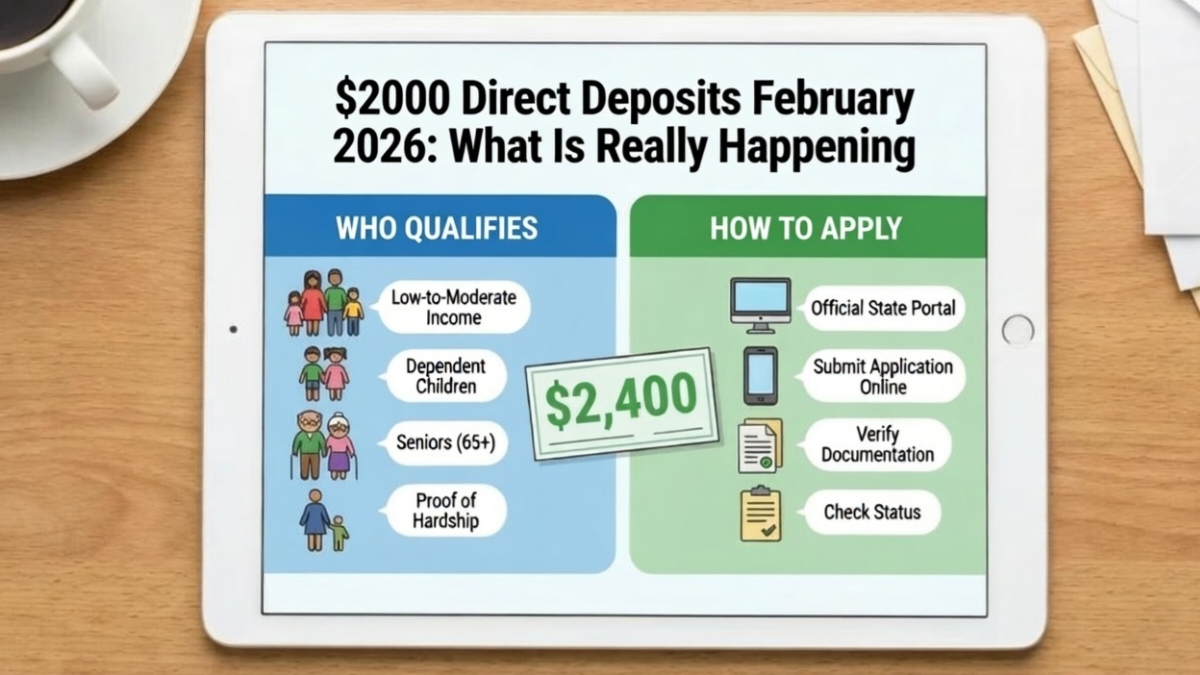

As February 2026 begins, many Americans are noticing online posts claiming that $2,000 direct deposits are appearing in bank accounts across the country. Screenshots shared on social media, forwarded messages, and discussion threads are creating the impression that a new federal payment has been approved. This has naturally caught attention, especially as families continue to struggle with high rent, costly groceries, insurance premiums, and medical expenses. In times of financial stress, even the idea of extra support spreads quickly.

However, these claims are misleading. There is no new nationwide $2,000 stimulus or relief payment being issued in February 2026. The money people are seeing in their accounts comes from existing government programs and routine tax-related payments. Understanding the real source of these deposits helps clear confusion and prevents false expectations.

No New Federal $2,000 Payment Has Been Approved

Despite widespread online discussion, lawmakers have not approved a new universal $2,000 payment for February 2026. There has been no official announcement from the federal government confirming such a program. Unlike the pandemic years, when emergency stimulus checks were rolled out quickly, current policy does not include blanket payments for everyone.

Also Read:

$1,000 or $3,000 Refund? The Route Your Return Takes Changes Arrival Time | IRS refund routes

$1,000 or $3,000 Refund? The Route Your Return Takes Changes Arrival Time | IRS refund routes

The deposits appearing in February are tied to programs that already exist. These include Social Security benefits, Supplemental Security Income, disability payments, veterans’ benefits, and IRS tax refunds for early filers. While the amounts may look similar to past stimulus payments, they are not connected to any new relief law.

Why Early-Year Payments Often Cause Confusion

January and February are always busy months for government payments, which often leads to misunderstandings. Social Security benefits reflect annual cost-of-living adjustments starting in January, meaning many recipients see slightly higher amounts. At the same time, tax season begins, and people who file early may start receiving refunds.

When these payments arrive close together, they can appear as one large deposit. Banking delays, weekends, and holidays can also shift posting dates, making deposits feel unexpected. This overlap is one of the main reasons people believe a new payment has been issued, even when it has not.

Who May Notice Deposits Close to $2,000

Not everyone will see a deposit near $2,000, and there is no fixed amount for all recipients. People most likely to notice deposits around this level are those who already qualify for higher benefits or refundable tax credits. Retirees with higher Social Security benefits may receive amounts close to this figure, especially after annual adjustments.

Low-income taxpayers who qualify for refundable credits, such as credits for children or earned income, may also see refunds near or above $2,000. Veterans receiving disability compensation or pension payments could notice similar amounts depending on their benefit level. Each situation is unique and depends on personal eligibility rather than a universal rule.

Why Federal Payments Are Different for Everyone

Federal payments are calculated individually, not as flat amounts. Social Security benefits depend on a person’s work history and lifetime earnings. Disability payments vary based on eligibility rules and medical qualifications. Veterans’ benefits depend on service records and disability ratings.

Tax refunds are even more variable. They depend on income, filing status, number of dependents, and which credits apply. Because of these differences, two people may receive very different amounts even if they are part of the same program. Online posts often ignore this complexity, which leads to unrealistic expectations.

How Payment Timing Adds to the Confusion

Payment schedules differ across programs. Social Security payments are issued based on birth dates, while SSI follows a separate fixed calendar. Tax refunds depend on when a return is filed and how quickly it is processed by the IRS. These different timelines can cause deposits to arrive within days of each other.

Banks also play a role. Some financial institutions release funds early, while others wait until the official payment date. When multiple payments post close together, they can look like a single new deposit. This timing issue is a major factor behind the $2,000 deposit rumors.

Growing Risk of Misinformation and Scams

Whenever rumors of government payments spread, scams increase. Fraudsters often promise guaranteed $2,000 deposits and ask for personal or banking information. Seniors, retirees, and low-income households are especially vulnerable to these tactics during times of financial uncertainty.

Government agencies do not contact people through unsolicited calls, texts, or social media messages asking for sensitive information. Any claim about a new payment should always be verified through official government websites. Staying cautious helps protect both finances and personal data.

What These Deposits Really Mean for 2026

The strong reaction to $2,000 deposit rumors reflects ongoing financial pressure rather than a new policy change. Many households are stretched thin, so any sign of extra money draws attention. While discussions about future relief programs may continue, there are no confirmed plans for a nationwide $2,000 payment in February 2026.

For now, the best approach is to understand existing benefits and payment schedules. Tracking official information allows people to plan realistically and avoid disappointment. Relying on rumors can lead to poor financial decisions, such as delaying bills while waiting for money that is not coming.

There is no approved nationwide $2,000 stimulus payment for February 2026. The deposits appearing in bank accounts are linked to existing programs like Social Security, SSI, SSDI, veterans’ benefits, and IRS tax refunds. The amount and timing of these payments depend entirely on individual circumstances, benefit eligibility, and tax filing details.

Understanding where the money comes from helps reduce confusion and prevents the spread of misinformation. As 2026 continues, checking official announcements and verified sources remains the safest way to stay informed about government payments.

Disclaimer

This article is for informational purposes only and does not provide legal, tax, or financial advice. No universal $2,000 federal payment has been approved for February 2026. Payment amounts and timelines vary based on individual circumstances and official government rules. Readers should rely on verified government sources or consult a qualified professional for personalized guidance.